Credit cards and loans may be difficult to obtain in this range, and the interest rates on your options might be higher.

The good news is that those with fair or average credit are rapidly approaching individuals with good credit (FICO score of 670 to 739).

You’ll also get access to newer financial products with better features and lower interest rates once you get there. And using a credit card is one of the best ways to get there.

The best credit cards for fair credit have elements that help you develop credit. Low or no fees, as well as free credit ratings and monitoring, may be among them.

When applied sensibly, lenders will notice your sound money management practices. Additionally, you can acquire worthwhile bonuses and discounts along the way.

Check out our recommendations for the best credit cards for fair credit and tips on how to improve your credit to assist you.

What is a fair score?

Discover what a fair credit score is, how it may impact you, and what you can do to raise typical credit ratings.

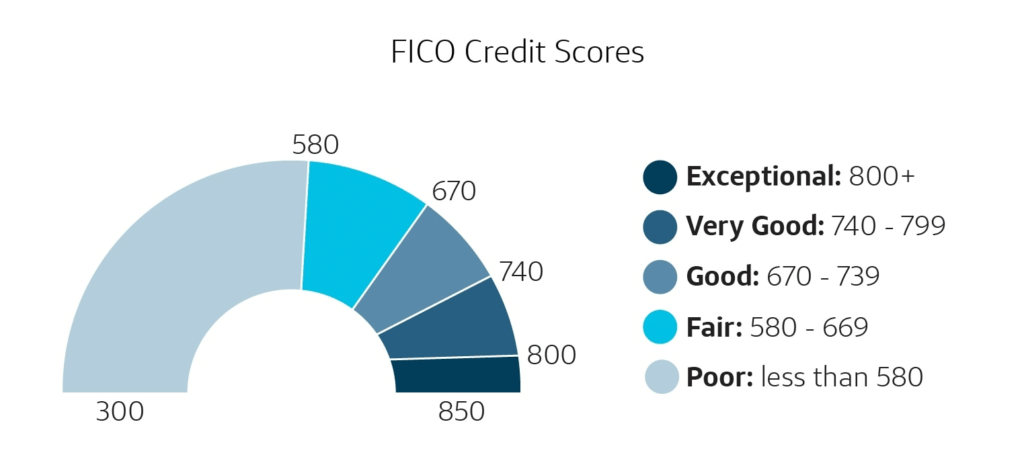

There are several different credit scores available. And the most widely used variations fall between 300 and 850. But what do fair credit scores actually mean? And in that range, where do fair credit ratings fit?

The answers can differ, as they can with many other aspects of credit ratings. Continue reading to find out how to determine if you have a fair credit score, why they are significant, and what you can do to raise yours.

Your Credit: Is It Fair?

Depending on the credit scores you’re looking at and the credit-scoring firm they come from, what’s deemed acceptable credit may vary slightly. The variations between the models from two widely utilized businesses are as follows:

A decent credit score, according to FICO®, falls between 580 and 669.

Fair ratings, according to VantageScore®, range from 601 to 660.

Lenders are ultimately responsible for determining what constitutes a fair credit score. But these are some specifics on how scores might be categorized:

Fair FICO Credit Scores

Exceptional (800–850): According to Experian®, a significant credit bureau, borrowers in this credit score range are most likely to be approved for credit and receive favorable interest rates.

Very good (740-799): According to FICO, these borrowers also frequently have credit scores that are higher than normal. This makes it simpler to be approved for credit and receive favourable conditions.

Strong (670–739): Because persons with good credit ratings have historically shown they can repay loans, lenders are typically prepared to extend credit to them.

Fair (580-669): Lenders may nevertheless approve applicants for credit products even though credit ratings in the fair range are below the national average in the United States. However, options might be constrained.

Poor (300–579): Applicants with credit scores in this range may be rejected. Alternately, the lender can accept the application but demand payment in advance.

Do not forget that scoring businesses have several iterations of their own scores. And that can lead to minor variations in the way scoring ranges are reported.

Credit Scores from FairVantageScore

VantageScore suggests the following criteria for evaluating its scores:

Excellent (781–850): This is the highest grade that can be given. Scores in this “superprime” level demonstrate a borrower’s ability to repay their debts.

Good (661-780): People with scores in this range, sometimes referred to as prime borrowers, are probably going to have little trouble obtaining loans authorized.

Fair (601-660): Obtaining loans or credit cards may be more challenging for those with fair credit scores. Additionally, loan approvals could have higher interest rates.

Poor (500–600): If a loan is accepted at all, having a credit score in this range may result in higher interest rates.

Very Low (300-499): Obtaining loans may be challenging, similar to poor credit. However, there are ways to raise your rating.

Good credit versus fair credit

You often fall in the middle of the credit score ranges if you have acceptable credit. The numbers increase as test results rise. Fair credit scores are a step up from good credit scores. FICO’s definition of a good credit score is between 670 and 739, whereas VantageScore’s good range is between 661 and 780.

You may be a better candidate for items like credit cards if your credit is better. But that’s only the beginning. Strong credit is crucial in several domains, including:

Credit cards: Whether you’re looking for a card with a strong rewards program or one with a low APR, your chances of being approved for one with a higher credit score may be improved.

Strong credit might also help you qualify for mortgages, auto loans, and other borrowing.

Interest rates: If you’re approved for a loan or credit card, the lender may base your interest rate and credit limit on your credit score. In general, having a higher credit score may enable you to negotiate better terms.

Rental applications: To determine whether you are eligible for an apartment lease, landlords may check your credit report.

Applications for jobs: Employers may run your credit reports as part of a background check with your express written consent.

Insurance rates: In accordance with state regulations, insurers may take your credit history into account when calculating premiums.

Deposits: For customers with good credit, phone and utility companies may decide not to need security deposits.

These are just a few of the benefits that come with having better credit scores. There are steps you can take to help your scores if you’re not happy with them.

Actions to Take to Help You Build Fair Credit

Even though you might be eligible for loans with fair credit, raising your score could result in better conditions. You can take the following actions to raise your fair credit score:

Utilize credit wisely. There are various ways to demonstrate to lenders that you are a trustworthy borrower. Aim to pay your payments on time each month to demonstrate to lenders that you are abiding by the conditions of your contract. Try to keep your credit card balances low as well. As an illustration, the Consumer Financial Protection Bureau (CFPB) advises limiting your overall credit card balances to 30% of your credit card limit.

Avoid making payment errors. Maxing out your credit card or paying only the minimum amount due might keep your credit utilization high and harm your credit scores. Paying your invoices late could also lower your credit score. Aside from credit, you could also end up paying extra in interest or fees.

Think about applications. A high number of credit accounts opened in a short period of time could lower your rating. Recent enquiries are taken into account in credit scoring systems. Additionally, lenders can have a poor view of your financial situation.

Observe your credit. Regularly reviewing your credit reports can assist in ensuring the accuracy of the data used to determine your credit score. Through CreditWise, you can see your TransUnion® credit report at any time. Additionally, AnnualCreditReport.com offers free copies of your credit reports from the three main credit bureaus: TransUnion, Equifax®, and Experian.

Avoid fast fixes. Keep in mind that credit-building takes time. There isn’t a quick remedy for bad credit. However, there is never a bad time to begin forming positive habits that will help you build your credit.