Unveiling the Power of Upgrade Personal Loans: A Comprehensive Review

In the realm of personal financing, where flexibility, convenience, and financial empowerment hold paramount importance, Upgrade Personal Loans shine as a beacon of opportunity.

Related topics

- You will stay on the same website

As we delve into this comprehensive review, we’ll uncover the myriad benefits, application process, and key features that set Upgrade apart in the competitive landscape of lending.

Loan Details: Empowering Your Borrowing Experience

When considering a personal loan, specific details can significantly impact your decision-making process.

Upgrade Personal Loans offer a range of loan amounts, APR rates, credit score requirements, term lengths, and funding speeds that cater to various financial preferences and needs.

Check your pre-approval status for credit cards and loans without any impact on your credit score.

By clicking “Sign Up”, you accept our Terms and Policy Privacy

Loan Amount: Upgrade Personal Loans provide borrowers with a versatile loan range, spanning from $1,000 to $50,000. This extensive spectrum ensures that whether you require a small boost or a substantial financial cushion, Upgrade has you covered.

APR Range: The Annual Percentage Rate (APR) for Upgrade Personal Loans varies between 8.49% and 35.99%. This range takes into account factors such as your creditworthiness, ensuring that the APR is tailored to your financial profile.

Recommendations

In-Depth Exploration of Marcus by Goldman Sachs Personal Loans

- You will stay on the same website

Discover Personal Loans: A Comprehensive Exploration for Potential Borrowers

- You will stay on the same website

The American Express® Green Card: A Gateway to Rewarding Travel and Dining Experiences

- You will stay on the same website

Marriott Bonvoy Brilliant American Express Card: Enjoy Luxury Benefits

- You will stay on the same website

Amex EveryDay Credit Card: earn 10,000 Membership Rewards Points

- You will stay on the same website

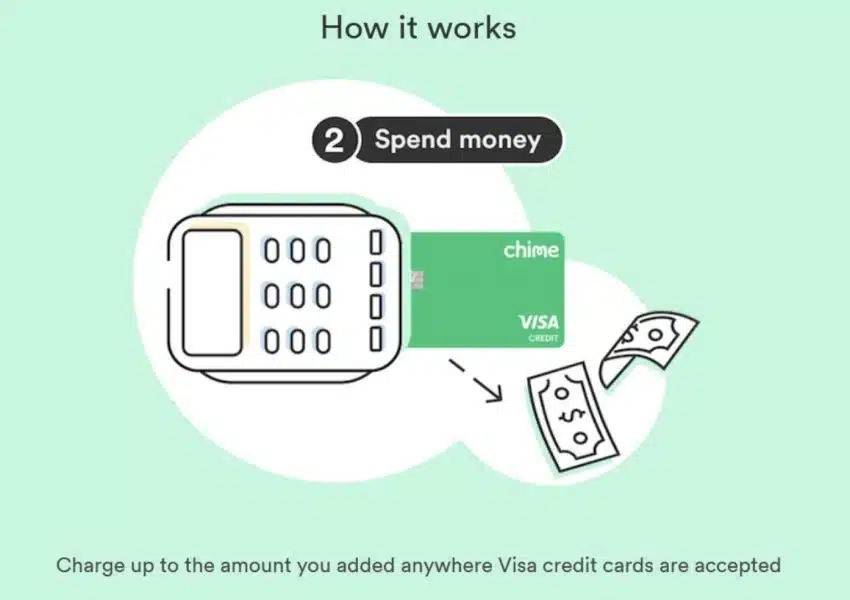

Chime Secured Credit Builder Visa® Credit Card: A Full Guide for People with Low Credit Scores

- You will stay on the same website

The Old Navy Credit Card: Maximizing Your Fashion Shopping Experience

- You will stay on the same website

An In-Depth Look at the Discover It® Secured Credit Card

- You will stay on the same website

Amazon Prime Rewards Visa Signature Card: Unlocking the Benefits

- You will stay on the same website

Unleash the Potential: Chase Freedom Flex Credit Card Review

- You will stay on the same website

The Capital One Platinum Secured Credit Card: Your Path to Stronger Credit

- You will stay on the same website

Unveiling the First Progress Platinum Prestige Mastercard Secured Credit Card

- You will stay on the same website

Milestone Mastercard: Navigating Credit-Building Waters

- You will stay on the same website

Building Credit Made Easy: The OpenSky Secured Visa Credit Card

- You will stay on the same website

Surge Platinum Mastercard Credit Card: An In-Depth Analysis and Updated Review

- You will stay on the same website

Unlocking the Potential of the Citi Double Cash Card: A Comprehensive Review

- You will stay on the same website

The Ultimate Guide to the Upgrade Cash Rewards Visa Card

- You will stay on the same website

Maximizing Your Financial Potential with LendingClub Personal Loans

- You will stay on the same website

Review of the Wells Fargo Active Cash® Card: Earn 2% Cash Back Plus a Bonus

- You will stay on the same website

The U.S. Bank Secured Visa Card: A Comprehensive Review for Building Credit

- You will stay on the same website

Unveiling the Power of Avant Personal Loans: A Comprehensive Review

- You will stay on the same website

Everything You Need to Know About Zippyloan Personal Loans

- You will stay on the same website

Discover it Cash Back Card Review: Unveiling Discover’s Premier Rewards Card

- You will stay on the same website

Is the PREMIER Bankcard® Credit Card the Right Fit for Damaged Credit?

- You will stay on the same website

Capital One Quicksilver Cash Rewards: Beyond the Basics

- You will stay on the same website

Discovering the Destiny Mastercard: Your Ultimate Guide to Benefits and Features

- You will stay on the same website

LightStream: Illuminating Your Path to Financial Freedom

- You will stay on the same website

Building Credit with a Secured Visa Credit Card: A Path to Financial Stability

- You will stay on the same website

American Blue Cash Preferred® Card: Your Ultimate Guide to Cash Back Rewards

- You will stay on the same website

Net First Platinum: Your Path to Credit Building and Financial Empowerment

- You will stay on the same website

Accumulating Miles with the Chase Sapphire Preferred® Card: Your Ticket to Rewarding Journeys

- You will stay on the same website

Next Day Personal Loan Review: How Does It Work and Is It Good?

- You will stay on the same website

Unveiling Financial Freedom: A Comprehensive Review of the Chime Debit Card

- You will stay on the same website

The Self Credit Builder and Credit Card Combo: A Comprehensive Review

- You will stay on the same website

Reflex Platinum Mastercard: Affordable Credit Solutions for All

- You will stay on the same website

Navigating Your Finances with the Fit Mastercard: A Comprehensive Review

- You will stay on the same website

The Benefits of Capital One Preapproved Credit Cards: Simplifying the Application Process

- You will stay on the same website

Sam’s Club Credit Card: A Comprehensive Review of Benefits and Features

- You will stay on the same website

Amazon Credit Card: A Comprehensive Guide to Online Shopping Rewards

- You will stay on the same website

Discover the My Best Buy Visa Card: A Comprehensive Review

- You will stay on the same website

Steps to Apply for a TD Credit Card: A Comprehensive Guide

- You will stay on the same website

A Deep Dive Into Chime Credit Builder Visa Card: An Informative Guide

- You will stay on the same website

Unfolding the US Bank Credit Cards: A Comprehensive Guide

- You will stay on the same website

Unlock the World of Wells Fargo Credit Card: Benefits, Pros and Cons, How to Apply, and More

- You will stay on the same website

Learn how to apply for the Freedom Unlimited Rewards Card

- You will stay on the same website

How to Apply, Benefits, and More for a Bank of America Credit Card

- You will stay on the same website

Minimum Credit Score: To be eligible for an Upgrade Personal Loan, a minimum credit score of 600 is required. This benchmark opens doors for individuals with varying credit histories, providing them with an avenue for financial assistance.

Term Lengths: Upgrade offers term lengths ranging from 24 to 84 months. This flexibility empowers borrowers to choose a repayment period that aligns with their financial situation and goals.

Funding Speed: In a world where timeliness is crucial, Upgrade Personal Loans shine with their quick funding. Borrowers can access their funds as soon as one day after approval, ensuring that urgent financial needs are met promptly.

A Glimpse at Upgrade Personal Loans

Upgrade, a prominent player in the financial services arena, offers a range of lending solutions tailored to individual needs.

With a commitment to simplicity and transparency, Upgrade Personal Loans has captured the attention of borrowers seeking swift access to funds without the complexities often associated with traditional loans.

The Application Process: Seamlessness Redefined

One of the standout features of Upgrade Personal Loans is the seamless and user-friendly application process. In an era where time is of the essence, Upgrade’s digital platform ensures that applying for a personal loan is an effortless endeavor.

Borrowers can initiate the process by visiting Upgrade’s official website and providing basic information. This streamlined approach eliminates the need for extensive paperwork and long waiting times, a testament to Upgrade’s dedication to enhancing the borrower experience.

Keyword: Quick Approval Personal Loans

Empowering Financial Flexibility

Upgrade Personal Loans understands that financial needs are as diverse as the individuals seeking them. Whether it’s debt consolidation, home improvement, or unexpected medical expenses, Upgrade offers loan options to accommodate various purposes.

This flexibility empowers borrowers to address their unique financial situations without the constraints often imposed by traditional lenders.

Keyword: Versatile Personal Loans

Transparency at Its Best

Opaque terms and hidden charges have no place in Upgrade’s philosophy. A standout feature of Upgrade Personal Loans is their commitment to transparency.

Borrowers are presented with a clear and concise overview of the loan terms, interest rates, and any associated fees before they commit. This empowers borrowers to make informed decisions, fostering a sense of trust and reliability that is pivotal in the borrowing process.

Keyword: Transparent Loan Terms

Competitive Interest Rates: Your Financial Companion

Interest rates are a pivotal factor when considering a personal loan. Upgrade takes pride in offering competitive interest rates that align with the borrower’s financial profile. This commitment to fairness ensures that borrowers are provided with rates that reflect their creditworthiness, making the borrowing journey more affordable and sustainable.

Keyword: Competitive Personal Loan Rates

A Symphony of Simplicity and Technology

Upgrade’s marriage of financial expertise and technological innovation is evident in its online platform. The user-friendly interface not only simplifies the application process but also provides borrowers with a dashboard to manage their loan journey effortlessly.

From checking the loan status to making payments, Upgrade leverages technology to grant borrowers a high level of autonomy over their financial commitments.

Keyword: Online Loan Management

Customer-Centric Approach

In the realm of personal loans, exceptional customer service can be a differentiating factor. Upgrade excels in this domain by offering a customer-centric approach that prioritizes borrower satisfaction.

With a responsive support team ready to address queries and concerns, borrowers can tread the path of personal financing with confidence, knowing that a helping hand is just a message or call away.

Keyword: Personalized Customer Support

The Verdict: Elevate Your Borrowing Experience with Upgrade Personal Loans

In a world where financial aspirations thrive, Upgrade Personal Loans stand as a testament to innovation, flexibility, and unwavering customer dedication.

Whether it’s fulfilling immediate needs or embarking on a long-term financial journey, Upgrade’s range of personal loans offers a gateway to a brighter financial future.

The user-friendly application process, transparent terms, competitive rates, and customer-centric ethos collectively establish Upgrade as a leader in the lending landscape.

Elevate your borrowing experience with Upgrade Personal Loans today and unlock a world of financial possibilities that are tailored to your unique needs and aspirations. Experience the power of Upgrade and embrace a future of financial empowerment.